BMLL Market Lens: US Liquidity Maps provide insight into the US equity markets with a view of the top 500 US stocks across the major trading and execution venues over a 13-month period.

ABOUT BMLL

BMLL Technologies is the leading, independent provider of Level 3 Historical Data and Analytics for the world’s most sophisticated Capital Markets participants.

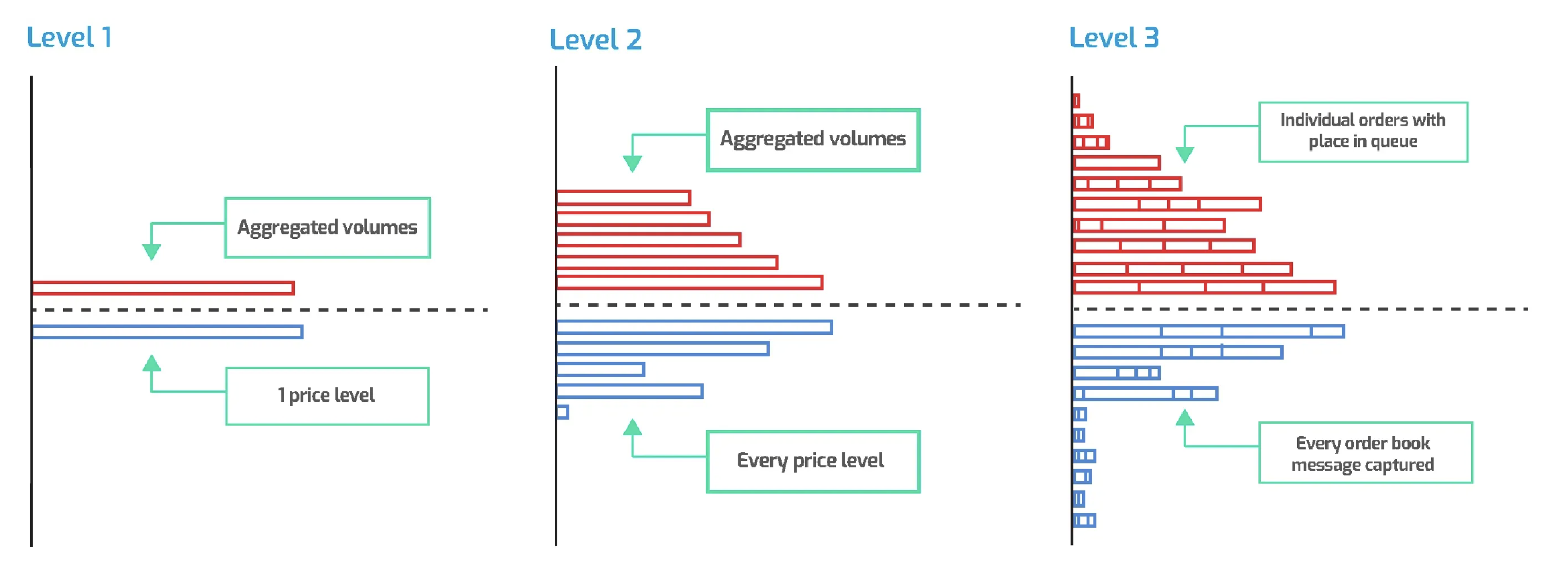

Level 3 Data captures and displays the trading intentions of all market participants. BMLL clients access this deep data to derive predictable insight. Researchers and quants across global financial services are empowered to truly understand how markets behave.

LATEST NEWS & INSIGHTS

QuantHouse division has entered into a global partnership with BMLL, a leading, independent provider of harmonised, Level 3, 2 and 1 historical data and analytics for the global equity and futures markets.